What is a Cash Flow Forecast?

A cash flow forecast outlines income and operating expenses for a business over the next 12 months. This cash flow forecast is required when a new start business is looking to acquire equipment finance for the first time or an existing business requiring finance to purchase an additional item of equipment – when the current year’s financial statements do not service the proposed facility.

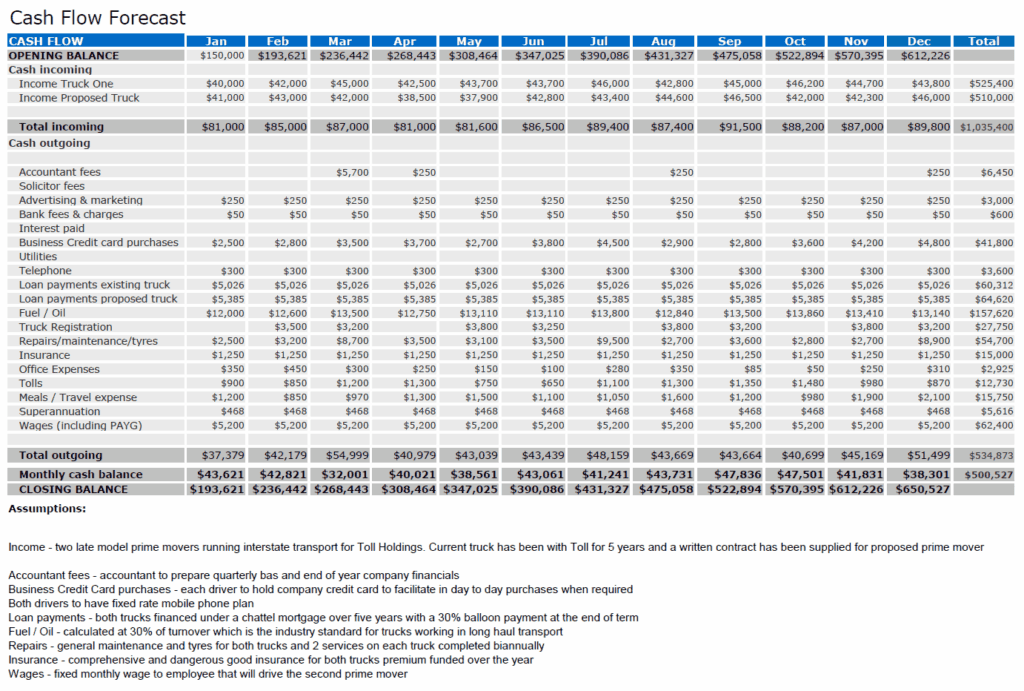

Below is an example of what a cash flow forecast looks like, along with the supporting assumptions explaining the income and expenses in the projection. This cash flow relates to a scenario of an existing owner driver looking to obtain truck finance to purchase a second prime mover.

Before we submit a deal to our Credit Manager, we have to prepare a cash flow forecast in the event a client’s most current company financials are not sufficient to service the existing truck loan plus an additional loan for the proposed truck. The current company financials obviously don’t show any income for a second truck.

Example Cash Flow Projection

When an equipment finance deal is assessed on a cash flow projection basis, a small risk premium might be attached to the rate documented on the loan. There is increased financial risk to the financier when a deal is assessed using a cash flow projection, based on the fact that the numbers in the forecast are only estimated figures and do not have any historical backing.

Over the years, our office has received enquiries from many different Transport and Heavy Equipment Operators, asking if we can assist in the finance of additional capital equipment, as their current bank had declined their request for finance due to lack of serviceability. Given the fact we specialise in Heavy Equipment Finance; we routinely help out those that are new start or growing businesses that need a little extra help to get things moving forward.

In addition, whilst the above cash flow forecast relates to a Transport business looking to expand their fleet, a forecast is often required when Farm Machinery Finance is difficult to obtain by Farmers who are draught affected or have had a crop destroyed due to storm or frost. If a farmer has had a bad couple of years due to these adverse conditions, their company financial statements more than likely will not service the existing and proposed Farm Equipment Loans. Sometimes the big four banks can be a little unforgiving to Australian Farmers, but we are willing to look for solutions to the inherent risks associated with the Agricultural Industry and will have a more risked based approach to these types of deals.

Heavy Vehicle Finance has a team of specialised Credit Analysts that can prepare simple cash flow projections like the one above, right through to very complex projects that involve multiple entities and large fleets of capital equipment. As we can prepare these projections for our client’s, we can save them thousands of dollars in Accountancy fees. If a client was to request their Accountant to prepare as cash flow projection for the purchase of truck finance, they might be charged anywhere from hundreds of dollars through to thousands of dollars.

Heavy Vehicle Finance has helped various Australian businesses secure equipment finance relating to all types of capital equipment over the years, even though they have found it difficult to obtain finance approvals elsewhere. If you need one of our specialist Credit Analysts to prepare cash flow projection to make sure you secure that next work contract, please give us a call on 1300 788 740.