What is a Credit Score? A credit score is calculated on information in an applicant’s credit report based on the conduct of any type of loan that they have taken out over the last 5 years. In Australia Banks, Utilities and any other lending institutions access credit reports of an applicant to determine whether or […]

A History of Australian Agricultural Machinery 1916-2016 [infographic]

Our clients obtain Farm Machinery Finance for a range of machinery for different requirements across the Australian agricultural sector. Below is a timeline showing the history and development of much of this machinery in Australia over the past century.

How Does a Balloon Payment Work For Truck Finance and Heavy Equipment Finance?

What is a balloon or residual payment? A balloon payment can be applied to any Truck Finance or Heavy Equipment Loan facility in order to reduce monthly payments and preserve cash for working capital purposes. A balloon payment might also be called a residual or RV depending on what type of loan is in place. […]

4 Options for Low Doc Truck and Heavy Vehicle Finance

As seen in previous articles on our site, there are many different factors that impact on truck finance and heavy equipment finance. The world of low doc lending even further complicates this process. Below is list of different low doc funding options available to customers of Heavy Vehicle Finance. Option One – Replacement Finance This […]

Interest Rate Implications for Truck and Heavy Equipment Finance

Unfortunately, some finance brokers / finance companies quote unrealistic or false interest rates to customers in an attempt to make a finance proposal look more attractive than what it actually is. Interest rate is not the biggest influence on monthly payments relating to truck and heavy equipment finance. It is for this reason, that customers […]

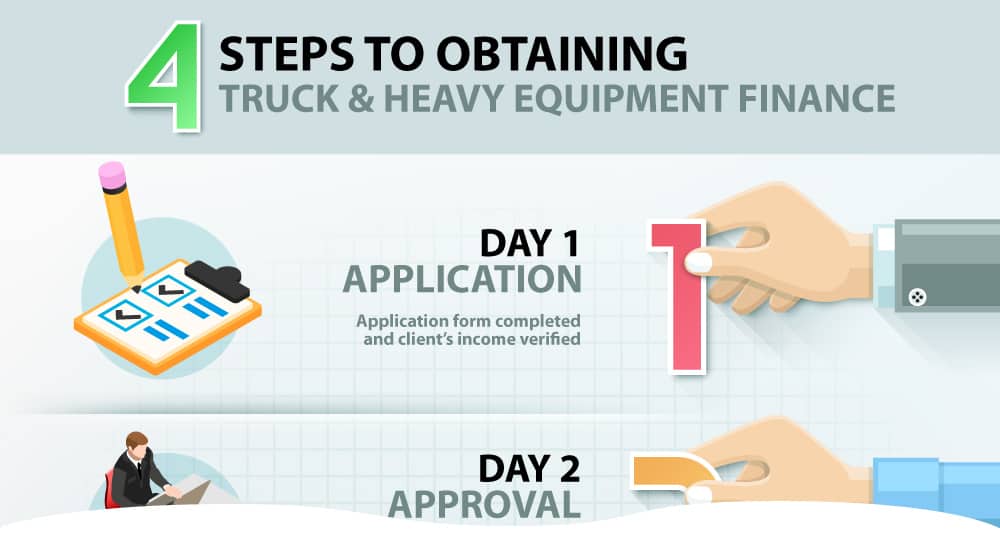

4 Steps to Obtaining Truck & Heavy Equipment Finance [infographic]

Clients often call to enquire as to the process and timeframes when obtaining Truck and Heavy Equipment Finance. We have compiled a simple flow chart below outlining our simple application process for our customers.

Facts of Financing an Older Truck Compared to a Newer Truck

When we advise clients that payments may not differ greatly between financing an older truck as opposed to a newer truck – they are often quite surprised. Below is an example as to why this may be the case. Asset Type Finance Amount Term Balloon Payments 2004 Prime Mover $80,000 3 years NIL $2,500 pm […]

8 Important Considerations When Applying For Truck Finance for a New Business

Our office regularly receives phone calls from potential clients seeking information on how to finance a truck when starting a new business. Below is a list of requirements and considerations when looking to finance a truck for those looking to become an owner driver. 1 – Has an Australian Business Number been Registered? Is it […]

What Does Asia’s Growth mean for Australian Industry

The exponential economic growth of Asia over the past two decades has reshaped how the world does business. With most Asian countries experiencing inflows of foreign investments, it is no wonder that Asia is currently regarded as a global economic powerhouse. Accompanying Asia’s massive economic growth is the inevitable population spurt. In China, a country with a current […]

Heavy Equipment and Truck Finance Broker verses The Bank

Heavy Equipment and Truck Finance Brokers The Bank Consultants that specialise in one area of finance – heavy equipment and truck finance Bank Managers work on home loans, overdrafts, insurance but don’t specialise in heavy equipment and truck finance Clients relationships are groomed for the long term and are given a dedicated Relationship Manager. This […]