In recent times, there has been various leading economists and other social commentators around the world, talking about the affect Artificial Intelligence (AI) will have on our labour markets and many different sectors of the economy. This AI technology is said to not only significantly impact on Australia, but for all Eastern and Western Countries […]

Advice: No Deposit Truck Finance for New Transport Business [video]

Advice on how to get No Deposit Truck Finance for a New Transport Business.

Why are the Big Banks Closing Local Branches?

History of Banks Over the last 200 years banks have played a large part in supporting families and businesses throughout Australia. During this time, banks have facilitated growth of the nation through home loan lending and business lending to consumers and business all over the country. Australia’s banking system has predominately been made up of […]

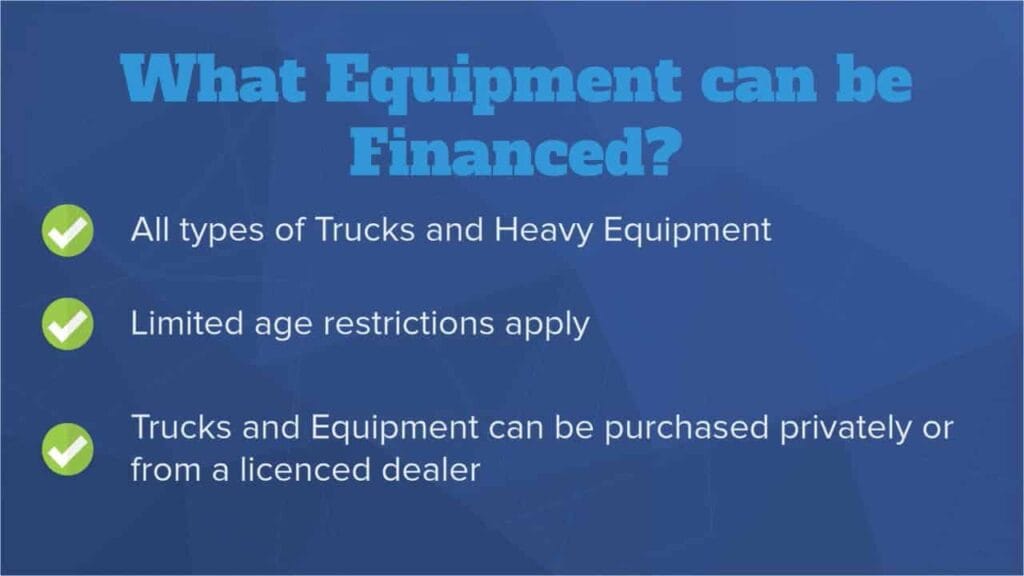

New No Deposit Low Doc Product for Truck and Heavy Equipment Finance

We are excited to release our new 100% low doc product for customers looking to purchase trucks or heavy equipment. This product is like no other in the market and most certainly is not offered by any of the big banks. Features of the new product are as follows; No Deposit Finance Under this new […]

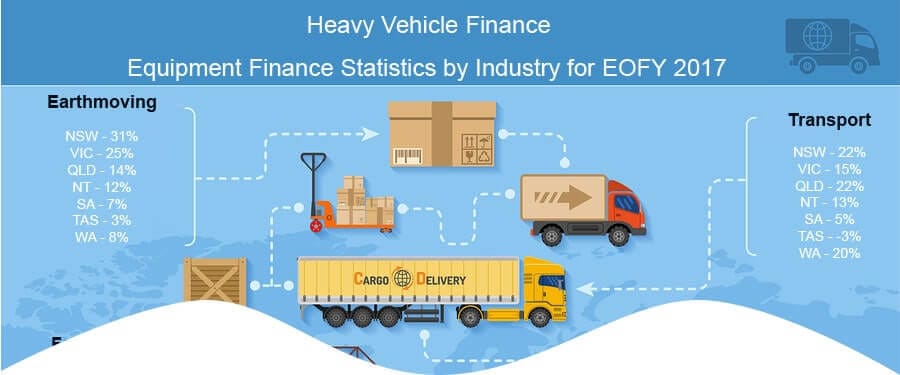

Heavy Vehicle Finance – Equipment Finance Statistics by Industry for EOFY 2017 [infographic]

The below infographic provides an outline of our overall Truck Finance and Heavy Equipment Finance settlements for the 2017 Financial Year broken down by state and industry. If you wish to develop a relationship with a specialist Heavy Equipment Finance company, you can apply online with Heavy Vehicle Finance or call us on 1300 788 […]

Defaults Against Australia Companies with Unpaid Tax

Word on the street is that the Australian Tax Office (ATO) will have the power to lodge payment defaults against businesses that have an outstanding tax debt of over $10,000 and who have not entered into a satisfactory payment arrangement. This comes amidst the Australian Governments need to increase revenue to meet the proposals outlined […]

Private Funding For Truck and Heavy Equipment Finance

What is Private Funding Private funding is when a group of private investors put up capital so that a customer can purchase Capital Equipment such as Trucks, Earthmoving Equipment, Farm Machinery and similar type assets. Banks on the other hand are able to lend money to their clients due to the fact that their customers […]

Why Would You Use the Big Banks for Truck Finance? [video]

Why use the big banks for truck and heavy equipment finance when you can use a company that ONLY specialises in this type of funding. Please see video above for more info…

How to Promote Your Earthmoving Business

One of the biggest challenges faced by those transitioning from an operator working for wages to becoming self-employed, is how to promote the business to ensure they get sufficient work to move the business in a forward direction. Below are some basic tips on how to successfully promote a newly formed Earthmoving Business. Create Stationery […]

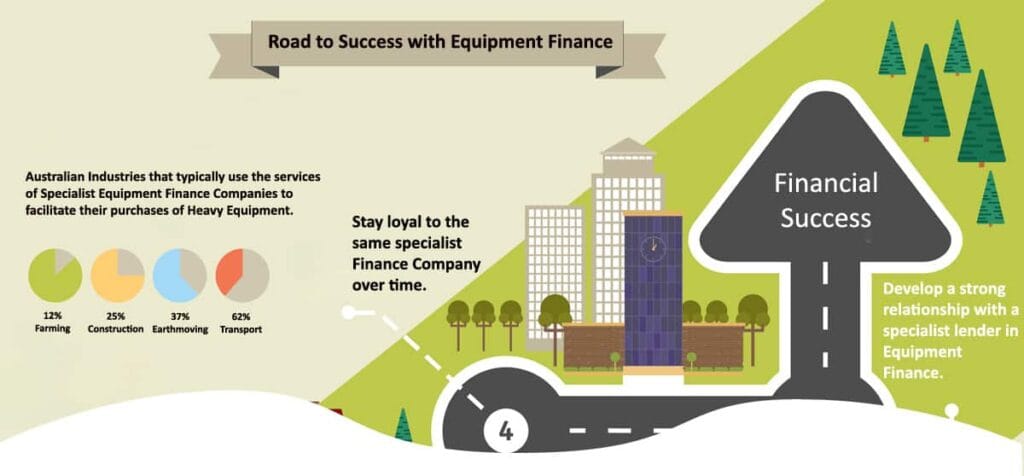

Road to Success With Equipment Finance [Infographic]

Are you a business looking to grow your fleet of capital equipment? The below infographic provides some advice on how to achieve the most successful outcome when applying for Truck Finance or Heavy Equipment Finance. If you wish to develop a relationship with a specialist heavy equipment finance company, you can apply online with Heavy […]