In times past, people would visit their local Bank Manager in order to apply for Equipment Finance relating to the purchase of Trucks or Heavy Equipment. This would mean that the applicant would need to take time out of their busy schedule to meet with a Bank Manager in order to discuss their funding proposal. […]

Factors that Could Derail an Equipment Finance Credit Application

The following article will show the main factors that could jeopardise an applicant’s ability to obtain Equipment Finance for Trucks and Heavy Equipment. Applying for finance with various financiers at the same time If someone looking for finance has many applications out at any one time, their credit file shows a credit enquiry with each […]

4 Factors that Will Drive Up the Demand for Australian Agriculture for 2016-2017

An annual report issued by RABO Bank has indicated that the outlook for the Australian Agricultural Industry is bright for 2016 / 2017. Below are 4 driving factors contributing to strong demand for goods and services in the Agricultural Industry. If you are looking for a great deal on Farm Equipment Finance with Seasonal Payments […]

What is Negative Equity when Buying a Truck?

Let’s say a Truck Driver is looking to trade in his current truck at his local dealership to step into a newer more reliable truck. Negative equity will occur if the dealership offers a trade in value on the truck that is lower than what the payout figure is on that same truck. For instance, […]

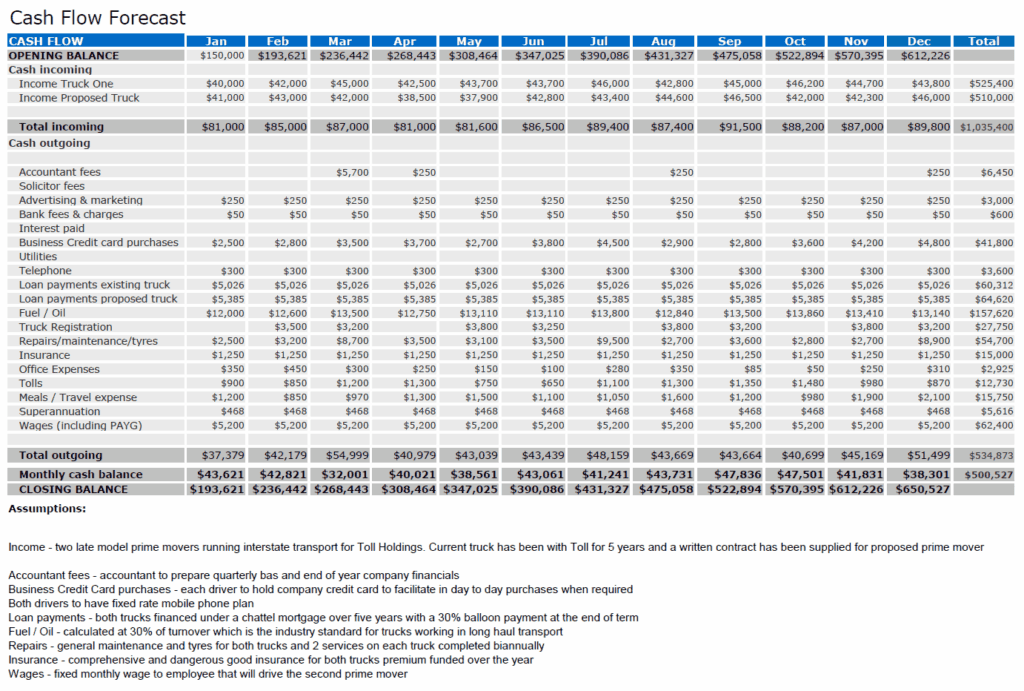

What is a Cash Flow Forecast?

A cash flow forecast outlines income and operating expenses for a business over the next 12 months. This cash flow forecast is required when a new start business is looking to acquire equipment finance for the first time or an existing business requiring finance to purchase an additional item of equipment – when the current […]

Can my Credit Score Impact on my Ability to Get Approval for Truck Finance?

What is a Credit Score? A credit score is calculated on information in an applicant’s credit report based on the conduct of any type of loan that they have taken out over the last 5 years. In Australia Banks, Utilities and any other lending institutions access credit reports of an applicant to determine whether or […]

A History of Australian Agricultural Machinery 1916-2016 [infographic]

Our clients obtain Farm Machinery Finance for a range of machinery for different requirements across the Australian agricultural sector. Below is a timeline showing the history and development of much of this machinery in Australia over the past century.

How Does a Balloon Payment Work For Truck Finance and Heavy Equipment Finance?

What is a balloon or residual payment? A balloon payment can be applied to any Truck Finance or Heavy Equipment Loan facility in order to reduce monthly payments and preserve cash for working capital purposes. A balloon payment might also be called a residual or RV depending on what type of loan is in place. […]

4 Options for Low Doc Truck and Heavy Vehicle Finance

As seen in previous articles on our site, there are many different factors that impact on truck finance and heavy equipment finance. The world of low doc lending even further complicates this process. Below is list of different low doc funding options available to customers of Heavy Vehicle Finance. Option One – Replacement Finance This […]

Interest Rate Implications for Truck and Heavy Equipment Finance

Unfortunately, some finance brokers / finance companies quote unrealistic or false interest rates to customers in an attempt to make a finance proposal look more attractive than what it actually is. Interest rate is not the biggest influence on monthly payments relating to truck and heavy equipment finance. It is for this reason, that customers […]