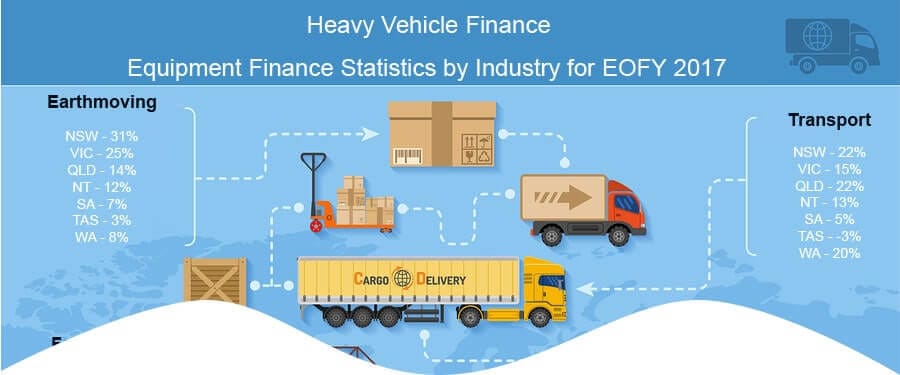

The below infographic provides an outline of our overall Truck Finance and Heavy Equipment Finance settlements for the 2017 Financial Year broken down by state and industry. If you wish to develop a relationship with a specialist Heavy Equipment Finance company, you can apply online with Heavy Vehicle Finance or call us on 1300 788 […]

Truck Finance [video]

Looking for a company that specialises in Truck Finance and Heavy Vehicle Finance? This short video explains how Heavy Vehicle Finance can help.

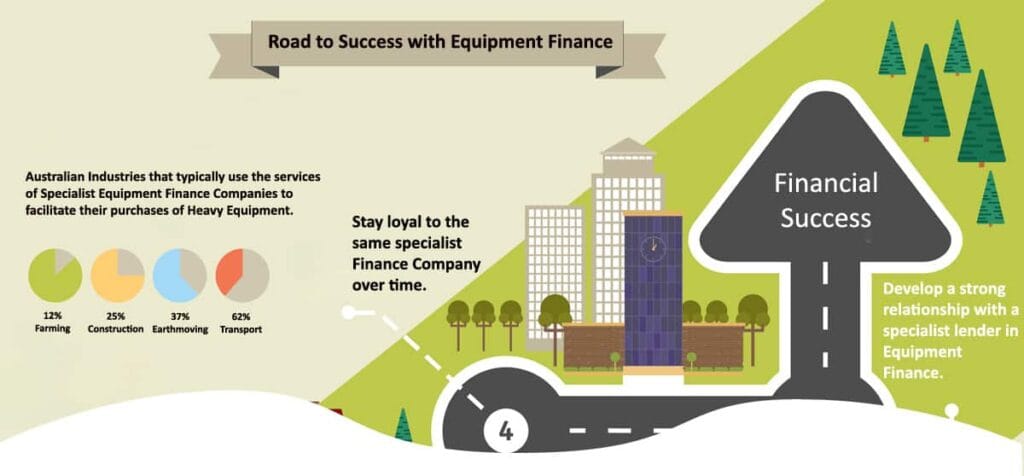

Road to Success With Equipment Finance [Infographic]

Are you a business looking to grow your fleet of capital equipment? The below infographic provides some advice on how to achieve the most successful outcome when applying for Truck Finance or Heavy Equipment Finance. If you wish to develop a relationship with a specialist heavy equipment finance company, you can apply online with Heavy […]

Emerging Trend Towards Applying for Truck Finance Online

In times past, people would visit their local Bank Manager in order to apply for Equipment Finance relating to the purchase of Trucks or Heavy Equipment. This would mean that the applicant would need to take time out of their busy schedule to meet with a Bank Manager in order to discuss their funding proposal. […]

What is a Private Sale for Truck and Heavy Equipment Finance?

A private sale occurs when the truck or equipment being sold is through a private individual or company. The private individual or company selling the equipment is not a licenced truck or equipment dealer but a business on selling equipment to another party. Finance companies consider vendors in three separate categories; Private Sales – a […]

What is Negative Equity when Buying a Truck?

Let’s say a Truck Driver is looking to trade in his current truck at his local dealership to step into a newer more reliable truck. Negative equity will occur if the dealership offers a trade in value on the truck that is lower than what the payout figure is on that same truck. For instance, […]

5 Factors That Influence Interest Rates for Truck Finance

Below are 5 factors that a Financier considers when setting the interest rate for Truck Finance transactions. If you’re looking for a great deal on Truck Finance, please call us today on 1300 788 740 or for instant Truck Loan Approval please complete our Online Truck Finance Pre-Approval Form.

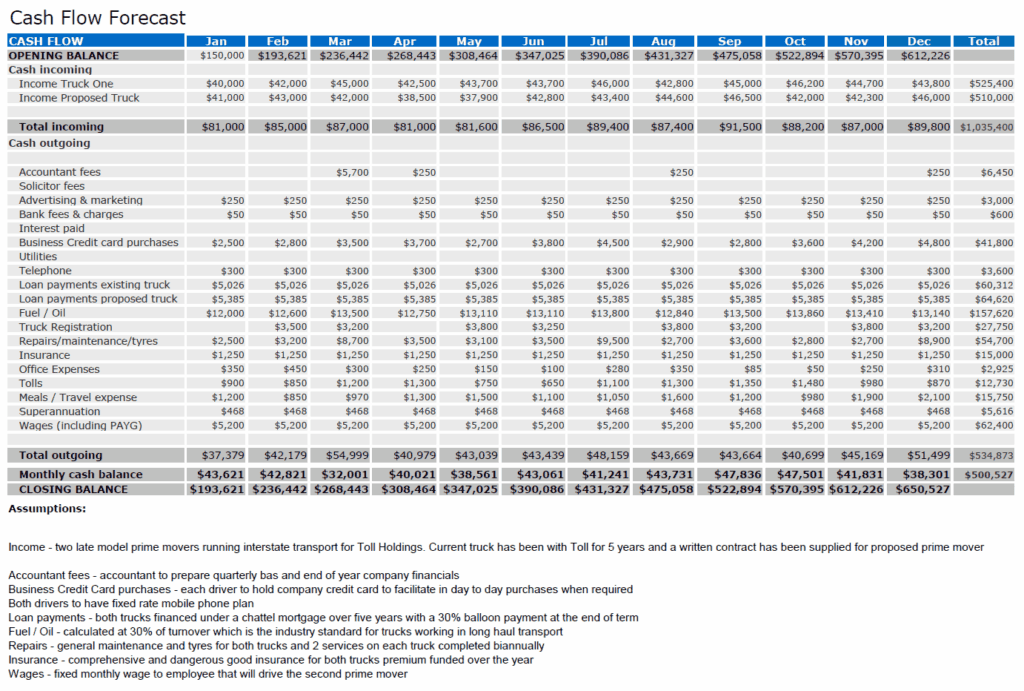

What is a Cash Flow Forecast?

A cash flow forecast outlines income and operating expenses for a business over the next 12 months. This cash flow forecast is required when a new start business is looking to acquire equipment finance for the first time or an existing business requiring finance to purchase an additional item of equipment – when the current […]

Can my Credit Score Impact on my Ability to Get Approval for Truck Finance?

What is a Credit Score? A credit score is calculated on information in an applicant’s credit report based on the conduct of any type of loan that they have taken out over the last 5 years. In Australia Banks, Utilities and any other lending institutions access credit reports of an applicant to determine whether or […]