Introduction: Truck Finance and Your Credit Score If you’re planning to finance a truck in Australia – whether you’re an owner-driver, small fleet operator, or logistics business – your credit score is one of the most important factors lenders consider. A good credit score opens doors to better truck finance options, lower interest rates, and […]

Beyond the Rate: Why Truck Loan Payments Matter More Than Interest

Introduction The dream of owning and operating a successful trucking business often begins with a critical decision: securing the right financing. When a new owner-operator or fleet manager begins the search for a truck loan, the first number they typically focus on is the interest rate. It’s a natural inclination; we’re conditioned to seek the […]

Why It’s So Important to Use a Finance Broker for Truck Finance in Australia

Introduction When it comes to purchasing trucks for your business in Australia, choosing the right truck finance solution is just as important as selecting the right vehicle. Whether you’re an owner-operator, a growing logistics company, or starting out with an ABN, the process of securing truck loans can be complex, time-consuming, and expensive if you […]

Tips on Applying for Truck Finance online

Over the last 5 years, an increasing number of customers are applying for finance via online sources. There has been a definite shift from the traditional method of walking into the local bank to discuss funding options as has previously been done for many years. In times past, customers had access to only major lending […]

Has Covid-19 Impacted on My Ability to Borrow for a Truck?

Events of March to April 2020 Recent measures put in place by the Federal Government have not been seen in Australian Society since the Great Depression. Social distancing and the total shutdown of bars, clubs, cafes and restaurants (to name a few) will invariably impose a huge economic cost on many small to medium businesses. […]

Should I Work for a Boss or Start My Own Transport Business?

People should carefully consider the pros and cons of either working for a boss or to start their own business. This article will run through what should be considered before making a decision either way and what steps need to be taken before starting a new business. Pros of Working for a Boss Stable income […]

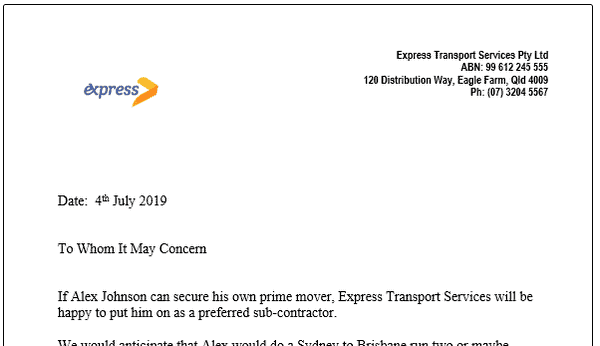

What is a Work Source Letter?

The below work source letter or work intent letter is an example only and does not represent any actual company in Australia. However, finance companies might request a work source letter in the following situations; New start business When an additional truck is being purchased and serviceability is tight based on historical financial statements Please […]

Can I get a Truck Loan if I don’t own a house?

In short, the answer to this question is yes you can – BUT it all depends on which financial institution you apply with. Generally, the big four banks would not give a truck loan to anyone that does not own a house, unless the customer is contributing a large upfront deposit (30% or more) or […]

Why use a Truck Finance Broker?

A Truck Finance Broker obtains finance on behalf of their customers, so they can make purchases of trucks or heavy equipment. A Truck Finance Broker will gather information from the client and then ascertain which financial institution is most likely to approve the funds required. Once the loan is approved and the transaction is settled, […]

Ways to Manage Working Capital for a Transport Business

One of the key areas required to succeed in a transport business, is proper management of the working capital position. If working capital is not managed successfully, a business will not be able to meet ongoing obligations such as wages, fuel accounts, mechanical accounts, taxation and other business-related expenses. What is Working Capital? Working capital […]