Introduction: Truck Finance and Your Credit Score If you’re planning to finance a truck in Australia – whether you’re an owner-driver, small fleet operator, or logistics business – your credit score is one of the most important factors lenders consider. A good credit score opens doors to better truck finance options, lower interest rates, and […]

Beyond the Rate: Why Truck Loan Payments Matter More Than Interest

Introduction The dream of owning and operating a successful trucking business often begins with a critical decision: securing the right financing. When a new owner-operator or fleet manager begins the search for a truck loan, the first number they typically focus on is the interest rate. It’s a natural inclination; we’re conditioned to seek the […]

Why It’s So Important to Use a Finance Broker for Truck Finance in Australia

Introduction When it comes to purchasing trucks for your business in Australia, choosing the right truck finance solution is just as important as selecting the right vehicle. Whether you’re an owner-operator, a growing logistics company, or starting out with an ABN, the process of securing truck loans can be complex, time-consuming, and expensive if you […]

Has Covid-19 Impacted on My Ability to Borrow for a Truck?

Events of March to April 2020 Recent measures put in place by the Federal Government have not been seen in Australian Society since the Great Depression. Social distancing and the total shutdown of bars, clubs, cafes and restaurants (to name a few) will invariably impose a huge economic cost on many small to medium businesses. […]

Truck Finance [video]

Looking for a company that specialises in Truck Finance and Heavy Vehicle Finance? This short video explains how Heavy Vehicle Finance can help.

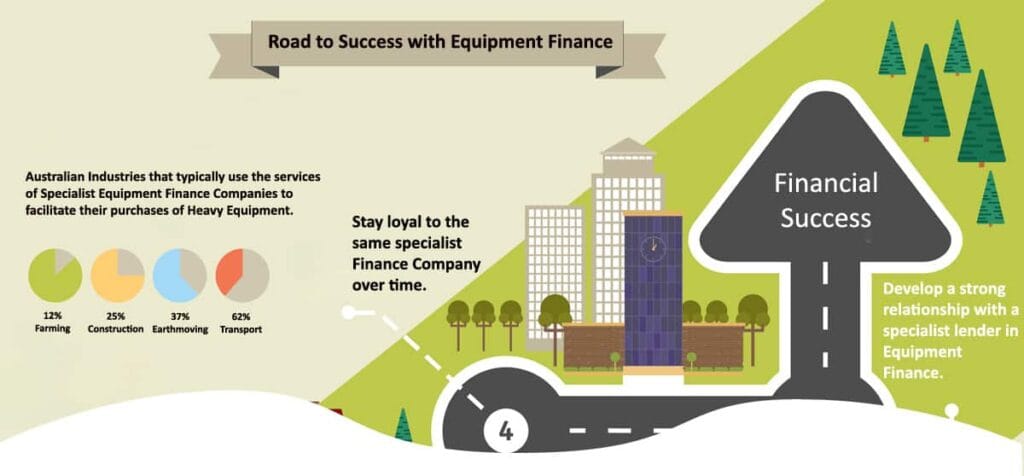

Road to Success With Equipment Finance [Infographic]

Are you a business looking to grow your fleet of capital equipment? The below infographic provides some advice on how to achieve the most successful outcome when applying for Truck Finance or Heavy Equipment Finance. If you wish to develop a relationship with a specialist heavy equipment finance company, you can apply online with Heavy […]

Emerging Trend Towards Applying for Truck Finance Online

In times past, people would visit their local Bank Manager in order to apply for Equipment Finance relating to the purchase of Trucks or Heavy Equipment. This would mean that the applicant would need to take time out of their busy schedule to meet with a Bank Manager in order to discuss their funding proposal. […]

Can my Credit Score Impact on my Ability to Get Approval for Truck Finance?

What is a Credit Score? A credit score is calculated on information in an applicant’s credit report based on the conduct of any type of loan that they have taken out over the last 5 years. In Australia Banks, Utilities and any other lending institutions access credit reports of an applicant to determine whether or […]

4 Options for Low Doc Truck and Heavy Vehicle Finance

As seen in previous articles on our site, there are many different factors that impact on truck finance and heavy equipment finance. The world of low doc lending even further complicates this process. Below is list of different low doc funding options available to customers of Heavy Vehicle Finance. Option One – Replacement Finance This […]

Facts of Financing an Older Truck Compared to a Newer Truck

When we advise clients that payments may not differ greatly between financing an older truck as opposed to a newer truck – they are often quite surprised. Below is an example as to why this may be the case. Asset Type Finance Amount Term Balloon Payments 2004 Prime Mover $80,000 3 years NIL $2,500 pm […]